DoubleDragon Properties Corp. reports net income figures for the year-end 2020 has reached Php 6.03 Billion, with total consolidated revenues of Php 14.26 billion.

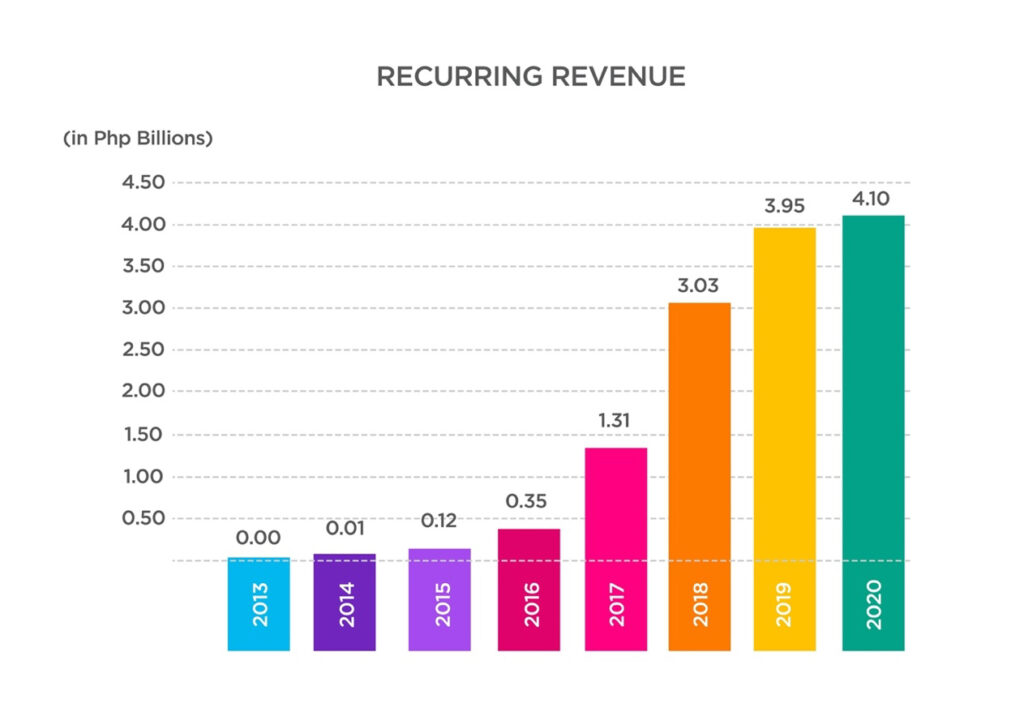

More importantly, DoubleDragon’s recurring revenues grew by 3.90% to Php 4.10 billion in 2020 compared to Php 3.95 billion the prior year primarily from the growth of its rental revenues which grew 10.20% to Php 3.90 billion in 2020 compared to Php 3.27 billion in the prior year.

Consolidated revenues -29.41% to Php 14.26 billion for the year-ended 2020 mainly due to the absence of substantial fair value gains booked the prior year.

Total assets of the company rose 6.48% year-on-year to Php 120.91 billion in 2020 compared to only Php 113.55 billion in 2019.

Total equity likewise increased by 11.71% to Php 49.06 billion in 2020 as compared to only Php 43.92 billion in the prior year equating to improved Gross Debt-to-Equity ratio of 0.97x as of December 31, 2020 vs. 1.03x in the prior year.

The company reports net income figures in the first three months of 2021 was P443.81 million, with total consolidated revenues of Php 1.52 billion.

More importantly, DoubleDragon’s recurring revenues grew by 11.44% to Php 1.03 billion for the first three months of 2021 compared to Php 927.91 million in the same period the prior year primarily from the growth of its rental revenues which grew 15.75% to Php 897.05 million for the first three months in 2021 compared to Php 774.97 million in the same period the prior year.

Consolidated Revenues -20.72% to Php 1.52 billion mainly due to the absence of fair value gains booked for the first three months of 2021 vs. the same period the prior year.

Total assets of the company rose 8.71 % in the first three months of 2021 to Php 131.44 billion compared to only Php 120.91 billion as of the end of 2020.

Total equity jumped significantly by 20.73% to Php 59.23 billion in the first three months of 2020 as compared to only Php 49.06 billion as of the end of last year equating to a new low Gross Debt-to-Equity ratio of 0.77x as of March 31, 2021 vs. 0.97x as of the end of last year.

The company’s unutilized Debt Capacity now stands at P92.16 billion. Because of the significant growth of the Company’s equity post REIT IPO, total equity is now substantially higher than total debt displaying solid financial strength.